.

Property tax notices and utility bills are mailed in late May. If you have not received your tax notice or utility bill, please contact our office by phone at 604-948-5295 or by email at taxation@tsawwassenfirstnation.com.

MYTFN SELF SERVE WEB PORTAL

As part of our continued effort to provide customer service, TFN is rolling out the myTFN web portal. myTFN provides homeowners access to their tax account status and utility balances using a private access code. This access code is printed on Property Taxation Notices and Utility Bills, but homeowners maintain their own account information online through a profile. The portal allows residents to look up specific transaction-based information to determine if payments have been received, adjustments made on their accounts, billing history, etc.

1. Create a myTFN Profile

Please click on the link below and follow the instructions provided. The portal will guide you through setup of a myTFN profile. Once your profile has been created and activated you can then attach property tax accounts and utility accounts to your profile.

2. Register a Property Tax Account

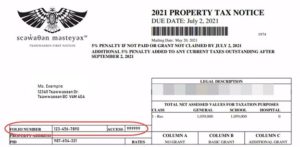

To register a property tax account on your myTFN profile you will need your Property Tax Notice. Once your myTFN profile is setup you will enter your Folio Number and Access Code as shown below.

3. Register a Utility Account

To register a utility account on your myTFN profile you will need your Utility Bill. Once your myTFN profile is setup you will enter your Account Number and Access code as shown below

If you still need assistance after following the instructions you can reach out to us at our office by phone at 604-948-5295 or by email at taxation@tsawwassenfirstnation.com.

DUE DATES AND PENALTIES

Property taxes and utility charges are due July 2nd*

On the day following July 2nd* a penalty of 5% of the amount of unpaid charges will be added to the outstanding balance.

On the day following September 2nd*, a subsequent penalty of 5% of the amount of unpaid charges, excluding penalties, will be added to the outstanding balance.

*Please note: If payment due dates fall on a weekend or statutory holiday, pay the next business day without penalty. Pay on time to avoid penalties.

PAYMENT METHODS

At your Financial Institution

Pay online or by telephone banking through your financial institution’s Bill Payment Service. Please inquire directly with your bank to confirm availability of the payment options and the bank’s processing times.

Property Tax Online Payment

- Bill Payee: Tsawwassen First Nation – Property Tax (or simply “Tax” depending on the bank)

- Account Number: Folio number as found on your Property Taxation Notice

Utility Online Payment

- Bill Payee: Tsawwassen First Nation – Utility (or an abbreviation such as “Utly”)

- Account Number: Account number as found on your Utility Bill

To ensure payments are on time, the online bill payments should be made at least 2-3 business days before the due date. It is important to keep your receipt, as proof of payment may be required.

By Mail

Mail your cheque made payable to Tsawwassen First Nation along with the bottom portion of your bill to Tsawwassen First Nation at 1926 Tsawwassen Drive, Tsawwassen, B.C. V4M 4G2. The payment must be received by us on or before the due date to avoid a penalty.

Cheque Dropbox available 24/7

Outside the front entrance of the Administration building at 1926 Tsawwassen Drive.

In Person

Pay by cheque at 1926 Tsawwassen Drive during our business hours: Monday to Friday, 8:30 am to 4:30 pm

Please remember to claim your Home Owner Grant Equivalent even if your taxes are paid by your mortgage company or online through Bill Payment Service.

.

Home Owner Grant Equivalent

Home Owner Grant Equivalent Application for the Current Taxation Year – Online Only (eHOGE)

The due date to claim the current year’s eHOGE is July 2nd*. To avoid a penalty charge on the eHOGE portion of any unpaid taxes, the eHOGE must be claimed electronically on or before September 2nd*. If you pay online through Bill Payment Service or through a financial institution you still need to submit your eHOGE to TFN electronically.

You can apply for the current year’s grant until December 31st, but penalty charges will apply after September 2nd*.

After December 31st, you have one year to apply for an extension to claim a retroactive HOGE.

*Please note: if the due date falls on a weekend or statutory holiday, you may claim the eHOGE on the next business day.

Residents can only claim their current year’s Home Owner Grant Equivalent through TFN’s online portal.

To submit your eHOG application you will need your Folio Number and Access Code as shown on the sample Property Tax Notice below.

Retroactive Home Owner Grant Equivalent Application for Last Year – on Printed Form Only

The homeowner grant may be available retroactively if you qualified for the grant last year and you did not apply.

Residents can submit their printed HOGE application for the retroactive HOGE claim by email to taxation@tsawwassenfirstnation.com or by mail or at mail slot drop-off outside the front entrance of the Administration building at 1926 Tsawwassen Drive.

A copy of the HOGE application can be downloaded by clicking the link below to download a PDF form.

Application Form for HOGE [PDF]

Only one HOGE can be claimed by you or your spouse each year. You may be required to submit additional documentation to establish your eligibility and HOGE’s are audited for up to seven years to ensure applicants are eligible for the grants they receive.

.

CHANGE OF OWNERSHIP OR ADDRESS

If ownership of the property has changed, please forward this notice to the new owner or return it to TFN. If you are the new owner and your name does not appear on this tax notice as registered owner, you are responsible for the payment of this bill.

If you do not receive an annual assessment for property leased on Tsawwassen Lands, as a holder of a registered charge you may request that BC Assessment adds your name and address to the assessment roll. This will ensure you receive an assessment notice and also update your mailing address on record with TFN. Please contact BCA directly. You can find instructions for how to make this request here: How to Request a copy of the Assessment Notice – Holder of a Registered Charge

If your mailing address on your property tax notice is not correct, please go to the BC Assessment website at www.bcassessment.ca and complete their online change of address form. Only registered owners are authorized to alter mailing address records. Notification given to TFN will not change property tax and assessment records.

All name changes are handled by the Land Title & Survey Authority of BC (LTSA). To change the name on your land title, or to register any changes to the ownership of a parcel of land, contact the LTSA. Further details can be found on the LTSA website: https://ltsa.ca/.